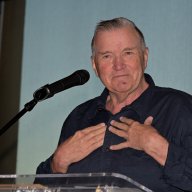

New York City Comptroller Scott Stringer. | NYC OFFICE OF THE COMPTROLLER

Establishing a major new front in the battle for LGBT workplace inclusion and fairness, New York City Comptroller Scott Stringer and California State Controller Betty Yee are calling on colleagues who, like them, manage major public pension funds to press corporate America to adopt policies to encourage LGBT membership on boards of directors.

In a May 26 letter to 19 officials nationwide who oversee state, municipal, and university system pension funds, Stringer and Yee wrote, “We want the best directors who possess a range of expertise and experience to serve on the corporate boards of the companies in which we invest. That is why we view board diversity, with LGBT inclusion, as integral to our fiduciary duties.”

Their letter points to statistics from Out Leadership – a group that works with corporate senior management to argue the business case for LGBT inclusion in the workplace – that just one third of one percent of all Fortune 500 board directors are openly LGBT, or less than 10 corporate directors in total. At the current time, only two of those companies specifically identify sexual orientation and gender identity in the diversity mission statement regarding their boards of directors.

City comptroller joined by California pension overseer in urging public officials to seek new diversity policies

According to Out Leadership, just 20 percent of LGBT business leaders are aware of any CEO who is trying to recruit board members from the community, while 80 percent of LGBT employees say they are more likely to come out on the job when senior executives are out. Tim Cook at Apple is the only out CEO at a Fortune 500 company.

While many investors are now willing to credit the general diversity argument being made by Stringer, Yee, and Out Leadership, the letter from the New York and California officials points to research published by the international investment firm Credit Suisse in April of this year that made a compelling data-driven case for the value of LGBT inclusion in top management.

Noting that almost 90 percent of Fortune 500 companies have adopted nondiscrimination and other inclusionary policies regarding LGBT employees, customers, and suppliers, the Credit Suisse report acknowledged that in many cases, that posture is “just a nominal policy position that is little beyond politically correct.” Out of more than 3,000 companies worldwide that Credit Suisse’s analysts cover, the report identified a basket of 270 for which nondiscrimination and inclusion are “central to corporate culture” – as evidenced by out members of senior management, active LGBT employee networks, or strongly positive reviews from outside evaluators.

The relative performance of those 270 companies as a group compared to an index of large and mid-capitalization companies in developed and emerging markets worldwide was striking, Credit Suisse found.

Over the past six years, that basket of 270 stocks outperformed the global index by 3 percent a year – and also outperformed a smaller index of North American, European, and Australian companies by 1.4 percent. Credit Suisse also found that return on equity and cash flow returns at the LGBT-inclusive companies were 10 to 21 percent higher than the market generally.

By these measures, companies with LGBT-friendly policies make for attractive investments, the study makes clear. The allure of such investments is even greater, Credit Suisse suggests, because despite higher returns and profitability, the 270 companies were trading at roughly a 10 percent discount based on their share price to earnings ratio. That means that even though their stock prices are outperforming the market, they are nevertheless undervalued and therefore may have greater upside for share purchasers.

Credit Suisse takes care not to try to establish cause and effect in all this.

“Do better companies have better LGBT policies and attract more LGBT employees or do LGBT employees make companies better?” the study asked. “Probably both.”

California State Controller Betty Yee. | BETTYYEE.COM

Either way, the findings are clearly a significant tool in the effort to press corporate America to do more and do better on LGBT diversity. The Stringer-Yee letter, which follows new Corporate Governance Principles and Proxy Voting Guidelines announced by Stringer on behalf of the New York City Pension Funds, was addressed to the governor of Minnesota, the state treasurers of Connecticut, Illinois, Maryland, Massachusetts, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington as well as the treasurers of Chicago, Houston, Los Angeles, Philadelphia, San Diego, and San Francisco.

Another recipient of the letter was New York State Comptroller Thomas DiNapoli, who like Stringer and previous state and city comptrollers has long been active on LGBT diversity issues in his capacity as a leading pension fund administrator. In April 2015, DiNapoli announced his office’s agreement with Monster Beverage, ranked 875 on Fortune’s list of largest corporations, and Standard Pacific Corp. (now CalAtlantic Homes), ranked 887, ensuring that those two companies would formally include sexual orientation and gender identity in their considerations when seeking diversity on their boards.

CalAtlantic’s agreement, DiNapoli said at the time, “is believed to be the first” by a US corporation guaranteeing consideration of LGBT diversity in board nominations.

The Monster Beverage agreement resulted from a proposal DiNapoli put forward in tandem with the pension funds of the City of Philadelphia and the State of Connecticut.

Stringer, Yee, and DiNapoli have all served as “ambassadors” in Out Leadership’s Quorum initiative aimed at increasing LGBT representation on corporate boards.

In an email statement that reiterated the theme that “research has shown that board diversity both enhances performance and mitigates risk,” Todd Sears, Out Leadership’s founder, said, “We’re proud of the support we’ve received from leaders such as Controller Yee and Comptroller Stringer as they’ve recognized that increasing board diversity isn’t just the right thing to do, it is an essential part of good governance and ensures companies are making every effort to improve their returns for investors. This message is resonating very strongly with asset managers from both the public and private sector.”

With just under $154 billion in assets under management, Stringer oversees the fourth largest system of public pension funds in the nation. Yee, who is responsible for the two largest – the California Public Employees’ Retirement System and its State Teachers’ Retirement System – oversees roughly $470 billion in assets. DiNapoli manages the third largest public pension program, the New York State Common Retirement Fund, with assets under management on March 31, 2015 of nearly $185 billion.